The Vanguard Wellington actively managed mutual fund is ranked number one because it has low fees, low turnover and, oh yeah, it’ll earn you lots of money! In this article, you’ll see the Wellington Fund’s rate of return, its asset allocation, hypothetical growth illustrations of your money, tax implications, overall pros, cons, how to buy, similar alternatives to the VG Wellington fund and much, much more. With this information, you’ll be well-prepared to make an informed decision about whether this type of investment is right for your financial goals. Let’s get started.

Table of Contents

The Basics

Since 1929, this fund has been returning an annual average of 8.2%, standing strong through the Great Depression and the Great Recession. That’s 87 years and counting.

The Vanguard Wellington Fund is a mutual fund — a collection of stocks and bonds owned by a group of people, just like you or me. The Vanguard Wellington Fund is a managed fund — meaning, a group of fund managers decide which stocks to buy. It boasts very, very impressive returns. And, the company that you buy through, Vanguard, has an excellent reputation. There’s a lot of buzz surrounding this fund for good reason.

Minimum Amount to Necessary to Begin Investing

The initial investment must be at least $3,000 — these are Vanguard Investor shares — if you’d like a lower expense ratio, you must invest at least $50,000.

Like most things in life, it’s best to start young. The earlier you start, the more time you have to reap the rewards. The Wellington fund is often described as the ultimate “set it and forget it” fund — pay in what you can as early as possible and watch it multiply over the years. But, if the majority of your years are behind you, don’t despair. Your portfolio may be larger, and that would nicely compliment the fund’s five-year annual return, currently standing at 7.94%. However, Vanguard suggests that the average effective maturity is 9.7 years, so plan to hold this fund for awhile for maximum gains.

The Fund’s Asset Allocation

As with most managed funds, the asset allocations are structured as per the fund prospectus. Funds will differ slightly as fund managers seek to optimize the fund. But, here’s the breakdown of the Vanguard Wellington:

60 to 70% of your investment is allocated in stocks. The remaining 30-40% of the Vanguard Wellington is put into fixed income securities. In other words, bonds, including those with exposure to the U.S. Treasury and Government and mortgage backed securities. A very small proportion, 0.28%, is invested in short-term reserves. These are investments that are to be liquidated shortly — things like bank deposits, short-term bonds, and U.S. Treasury bills.

Historical Rate of Return

Well, one reason it’s ranked #1 among the investing community is because of its track record. As mentioned earlier, it has averaged an annual return of 8.2%, with only 18 instances of negative total return in 87 years — four of those during the Great Depression. Its worst performing year was during 2008 – (remember that one?) – returning -22.3%. But in all fairness, there were very few financial winners in 2008. The total fund net assets now stand at $84.2 billion.

While financiers are often quick to remind potential customers that past results are not indicative of future performance (they are actually required to do so), Vanguard Wellington continues to buck this trend, making a name for itself for consistently high returns.

Fees

As mentioned earlier, the advantage of professional management comes at a cost, although Vanguard is known as the low-fee leader. For Vanguard Investor shares, you will pay a flat rate account servicing fee of $20, in addition to a 0.25% expense ratio and 0.01% fee for “other.” That 0.26% fee comes off the overall stock value. If you’ve invested $3,000, that will be $7.80 + $20. Vanguard Admiral shares (which, as mentioned earlier, you qualify for once you have $50,000+ invested) have an expense ratio of just .18% — that’s 80% lower than industry average.

If you invest $15,000, your fee would be just $39, as the $20 account servicing fee is inapplicable to accounts larger than $10,000. You can even spare yourself this fee by going paperless with your Vanguard statements, whether it is higher or lower than $10,000. This is obviously the method we recommend — and it’s greener, too! The Vanguard website is extremely user-friendly and most pages include the phone number for phone support if you get confused at any stage of the buying process.

Wondering about Vanguard’s fees versus Edward Jones’ fees? See our article for details.

Tax Implications

The actual amount of tax you’ll pay depends on how long you’ve held the product and your tax rate. Short term gains tax matches your own ordinary income rate. That range varies from 10% to 39.6%. Long term capital gains are taxed at a rate of 0, 15 and 20%. This, too, depends on your income. This is true of all investments, not just the Vanguard Wellington Fund.

Mutual fund shareholders are also subject to taxes on dividend distribution (income generated through interest and dividends), even if reinvested. Your state may require you to pay further local taxes, which differ from state to state. Every state taxes dividend income except the following: Alaska, Washington, Nevada, Wyoming, South Dakota, Texas, and Florida. If you don’t live in one of these states, you will receive a Form 1099-DIV (or similar). Vanguard is required to provide these by law for most accounts, so the legwork is done for you.

Some Hypothetical ROI Scenarios

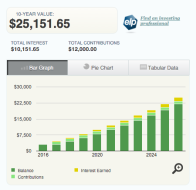

You understand the idea of mutual funds, the fees, and the taxes. So, what could you potentially earn from the top mutual fund in the country? Well, assuming you start with the minimum of $3,000 and pay in $100 monthly (remember: deposits are free!) for ten years, you could, pre-tax, be looking at quadrupling your money… twice.

This is assuming the current five-year average return of 7.94% holds up and, if it does, it would be in line with the lifetime return of just over 8%.

Sounds pretty good, right? But, let’s not forget those fees. Worst case scenario, you don’t manage your account online and pay $20 each year at a flat rate (up to $10,000 — then it’s free). That’s $100. Then you would pay 0.26% annually if you buy the more expensive Investor shares. This would start at $12, finishing up at $65 in your tenth year. Over ten years, you would be looking at about $365 in account management fees, plus your servicing fees until the value reaches $10,000. $465 in total. Very cheap. In fact, that’s 71% lower than similar funds. Do not fret about fees when considering this fund. They are very, very low.

To take it one step further, if you invested $3,000 + the compulsory $1 top-up NOW and left it to mature for 40 years, supposing the fund continued to perform above 7% you could have a balance of $45,000 for doing nothing at all (minus fees and taxes, of course).

Tax is a tricky one to calculate, as tax brackets vary from person to person. As touched on earlier, if you hold the investment for less than one year, you pay the same tax on them as your ordinary income rate. If you are in the 25% bracket, you pay 25%, and so on. After one year, short-term gains become long-term gains and are subject to reduced taxation. Another reason to stay invested for longer! If your ordinary income tax rate was 25%, you could expect to pay 15% in tax on a long-term gain. In the tenth year at 15%, that would be $3,772 (plus $65 in fees).

With up to 70% of your investment in stocks, inflation shouldn’t worry you too much, as companies’ earnings are generally expected to rise in line with inflation. The remaining 30-40% in bonds is a little trickier…

Rising inflation can cause banks to raise short-term interest rates. Bonds are subject to interest rate risk, and a rising yield can mean a falling price. But, it’s all about proportion, and with the Vanguard Wellington Fund the bulk of your investment should be synchronized with inflation.

Pros

- Age of the fund

- Almost unparalleled historical rate of return

- Exposure to large companies otherwise unattainable for individual investors

- Convenient – “set it and forget it” investing

- Professionally managed

- Vanguard-guaranteed securities protection up to $500,000 — backed by the SIPC

- Extremely low fees

Cons

- It is a managed fund, which doesn’t align with everyone’s investing philosophy

- Risk. 60-70% of your investment is open to stock market risk, and the remaining 30-40% is open to interest rate risk

Suggested Article: Here’s the List of Mutual Funds That Have Averaged 12% for the past Five Years (Hello, Dave Ramsey)

How to Buy

1. Through Vanguard Directly

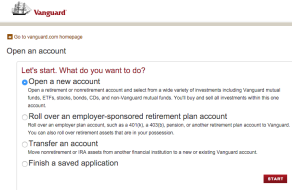

Buy through Vanguard. You can open a new account, transfer from other funds you have with Vanguard or easily switch from Fidelity, TD Ameritrade, Edward Jones, wherever you’re currently at. Vanguard makes the transition very painless (probably because they are eager for your business). Vanguard will guide you through its step-by-step process, and it has phone support if you are ever unsure. What’s more, there are no fees if you manage your account online, and it’s free to transfer assets to Vanguard from another company.

You can buy many, many funds with a Vanguard account. You don’t need to only keep Vanguard funds with them. The second screenshot shows how you can shop around to different fund families

But, do be aware of the fees that stem from other brokerage firms/other fund families, particularly if you are doing any inter-company buying or selling. It’s free to exchange one Vanguard fund for another. But, other companies may involve costs that vary dramatically.

2. A Different Brokerage Firm (e.g., Fidelity, E*Trade, TD Ameritrade, JPMorgan, Edward Jones, Etc.)

There are around 70 companies offering brokerage for the Vanguard Wellington fund. Fees are often transaction based, but will generally include commission, sales tax, mark-ups/downs, and more for each transaction. T. Rowe, for example, charges $19.95 per trade, plus $9.95 per transaction if you make 30+ transactions a year. You can choose a broker either by familiarity, or if you really can’t decide, try a broker comparison site.

Basically, since you’re not going to the source of the fund, it’s more expensive to go with a different brokerage firm than Vanguard. You should strongly consider opening a Vanguard account to hold this fund if you want to buy a lot of shares. You may end up liking Vanguard so much you switch over your entire portfolio.

Similar Mutual Funds

The Vanguard Wellington, as good as it is, isn’t the only stellar mutual fund out there. There are lots of alternative managed funds that offer similar asset allocations and similar returns. Let’s take a look at some of them…

Vanguard STAR — This fund is very similar to the Wellington, and while it still remains around 60% focused on stocks, it shifts some emphasis from bonds to short term reserves. It has returned around 8% annually, which matches the Wellington, but, crucial for some, you can start investing from just $1,000.

The AMCAP Fund — There are 1.4 million account holders taking advantage of this fund’s $250 minimum investment. It is heavily focused on U.S. equities, with these taking an 81% share of the funds, but it does also place around 5% in non-U.S. equities. Moreover, it has yielded 11.36% since 1967, and while its five-year yield is down slightly on recent years, it still stands at 10.51%.

Vanguard LifeStrategy Growth — This fund has been managed by the same basic team for 20 years, and whatever they are doing is working. It has an 80/20 split for stocks and bonds, and its holdings include four Vanguard index funds- – minimizing risk while accessing major market sectors. It has yielded 7.48% since inception, 22 years ago.

Buy, Buy, Buy?

Overall, the fund’s conservative approach and diversification have ensured the pursuit of, in the managers’ own words, “long-term capital appreciation, reasonable current income, and capital conservation.” Basically, it’s sensibly managed, risk is spread thoroughly and the portfolio is durable in volatile market conditions — perfect for first time or seasoned investors.

The fees are among the cheapest in the mutual funds market. While there are alternatives out there with lower initial investment requirements, it’s worth saving up for this fund.

As with all financial investments, you may not get back all the money you invest. There is no FDIC or NCUA insurance. All mutual fund investments are subject to risk. But, the Vanguard Wellington is both highly ranked and regarded, and has proven itself time and time again to offer an affordable and rewarding way to invest. If you want a well-rounded, high performing mutual fund with low fees… the Vanguard Wellington is for you. Add it to your portfolio, along with a few other of the funds we’ve recommended and you should do really well.

William Lipovsky

William Lipovsky

Lindsey Desmet

Lindsey Desmet

Kait Scirri

Kait Scirri

Caitlin Troutt

Caitlin Troutt

Jennifer Kostuch

Jennifer Kostuch

Brenna Swanston

Brenna Swanston

Erika Crawford

Erika Crawford

Cathy Desmet

Cathy Desmet

Loren Eaton

Loren Eaton

Joseph Cho

Joseph Cho

Maria R. Riegger, Esq.

Maria R. Riegger, Esq.

We are looking for investing options for teens. Do you know if minors are able to invest in these?

Hi Lisa,

Generally, minors won’t be able to invest on their own until they reach the age of majority (18 in most states, 21 in some). However, you can consider opening a custodial account in a teen’s name. Vanguard does offer UGMA/UTMA accounts for minors; you can read more about how these custodial accounts work and how to set one up on the Vanguard website. (If you’re interested, you can also look into this article from the Charles Schwab website about how to help a teen begin investing.) I hope this helps!

Thanks so much for this article. Right now I’m in a vanguard target fund, trying to build up to $3000 to invest in something better. But after reading this I’m going to move it to the STAR fund, build up to $3000 then move it to Wellington. Thank you so much!

I’m glad you’re putting the data to work! That’s a smart strategy you’re deploying and it’ll work without a hitch. And good call about leaving the target date fund. Convenience is never too profitable.