An insurance salesperson said I have the cheapest policy she has ever seen! We’ll show you how to get your car insurance even lower than $18 per month by picking the right type of insurance (you’re only required state minimum liability) and applying discounts, such as a good driver discount and by paying your bill on time.

My Car Insurance Policy

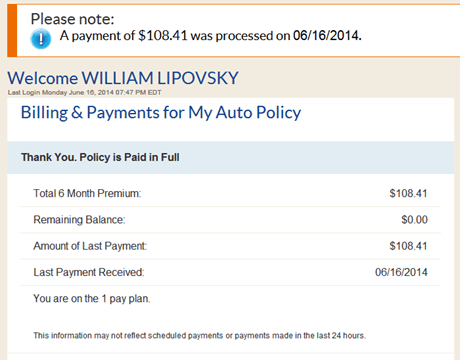

- Provider: GEICO

- Price per month: $18.07

- Price per six months: $108.41

- Policyholder: Myself

- Age, Gender: 23, male

- Vehicle: 1999 Mitsubishi Eclipse GS. Clean title. Color doesn’t matter. GEICO said if I had the faster (AWD Turbocharged) version of my car, the policy would still cost the same.

- Type of Insurance: State minimum liability. This means, if I crash into someone, GEICO takes care of all the damage, except for what happens to my own car. The state minimum is the minimum amount of insurance coverage mandated. If you want more coverage than the minimum, GEICO quoted me 70 cents extra for another $75k in coverage.

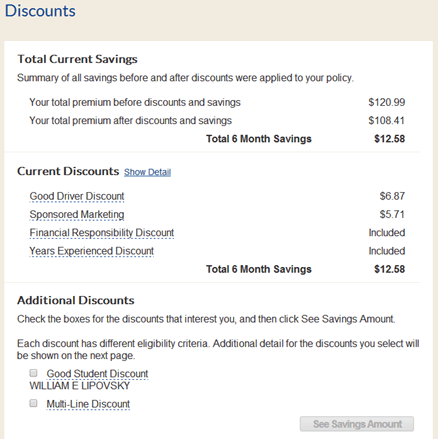

- Discounts: $65.91. My discounts include a Good Driver Discount (for no traffic violations) and a Financial Responsibility Discount (for paying my bill on time). The Sponsored Marketing discount is something I received for belonging to an honor society in college; there are many organizations GEICO partners with for this type of discount. Other discounts that may apply to you: student discounts, being a driver on your parents’ policy, and driving an older car.

- Negotiation skills required? I called GEICO on multiple occasions and spoke with quite a few people and got the same result. No negotiation required.

- Cons on my record: My car insurance lapsed for over a year. It’s like losing your credit score and having to rebuild it. My insurance would be cheaper had that never happened.

- Pros on my record: I’ve never had a traffic violation.

Other Insurance Companies’ Quotes

- Allstate: $26 per month

- State Farm: $27 per month (by piggy-backing on my parents’ policy)

- Travelers/AAA: $33 per month

- 21st Century: $45 per month

- American Family, Progressive, and Nationwide: Each quoted $50-$60 per month

- Liberty Mutual: $74 per month

- The General and a few others: So high I won’t even write it here!

In Summary

I called a lot of insurance companies and people in the business to pick their brains for this article. My biggest takeaway was: Don’t go with an insurance agent. You will always pay more when you go with one. How do you think the insurance company pays them? You pay them.

Also, all cheap auto insurance comparison sites are garbage. Yes, they will give you a rough idea of what each company charges but you never know the real amount until you call the company directly.

Since I rarely drive my car, I looked into plans that would reward me for limited miles. Progressive’s Snapshot Discount program was the only one that came close to GEICO.

Oh, and GEICO’s customer service is top notch! Car accidents tend to be less stressful when you’ve got a good group of people on your side.

Suggested article: The List of Car Insurance Companies That Don’t Check Your Credit

William Lipovsky

William Lipovsky

Lindsey Desmet

Lindsey Desmet

Kait Scirri

Kait Scirri

Katie Spence

Katie Spence

Erika Crawford

Erika Crawford

Cathy Desmet

Cathy Desmet

Loren Eaton

Loren Eaton

Joseph Cho

Joseph Cho

Maria R. Riegger, Esq.

Maria R. Riegger, Esq.

My monthly payment for state minimum here in Texas is $90. I need truly affordable insurance — not Elephant, which wants $250 a month, or Progressive, which wants $175 a month. Where can I get realistic quotes on car insurance?

Hello, Deborah. We have a related article you may find helpful: our guide to online car insurance quotes. This article lists the pros and cons of several popular insurance rate comparison sites. Best of luck with your search!

I am 76 years old. Haven’t had a serious accident ever. One fender bender 3 years ago. My credit is poor. I am a retired disabled vet. No tickets. I didn’t get a ticket when I had the fender bender. I need car insurance on my 2005 Ford Excursion. My residence is in Ferguson, Missouri.

If anyone can help me, I would really appreciate it.

I had car insurance but paying a high premium. It just lapsed two weeks ago. I am temporarily currently in China and don’t even drive my car but when I return to the states for two or three weeks. I need help. Thank you.

Robert

Hi Robert,

While I don’t know all the specifics to be able to tell you which car insurance company would offer the cheapest premium for you, what’s great is that most insurance companies offer instant online quotes that will save you time and allow you to get your car insurance reinstated upon returning from China. Progressive is a good one to try, as they include their quote, along with the quote of other insurance companies. You can start the process here.

Never ever ever ever ever carry less than $1Million liability. If god forbid you were to ever hit someone and seriously injure them, your life is over.

I’m 34 years old, been driving since i was 20, never had an accident until last year when the road was slick and i slid under a lady’s bumper. No insurance company will give me anything below $150 a month, and to be honest at a job that will barely give me 32 hours a week, with mortgage, power, water, and cable. I can’t afford that every month.

this includes geico and progressive. I don’t know any way to get a lower rate. Help?

Hi Shaun,

One relatively quick and easy thing that other readers have suggested is taking a defensive driving classes. That can lower rates pretty significantly. Besides that, it’s worth just putting in some research — it’s not a bad idea to just call up every major insurance company and see what kind of offer you can get, and don’t be afraid to cite the price you’ve been given elsewhere and see if another company can beat it. Ask about discounts everywhere: good student, accident-free, a member of a club, etc. There’s just so many factors to consider, unfortunately I wouldn’t be able to even ballpark what you should expect to get — but if you get in touch with all the major companies, you’ll at least know that you’re getting the best deal that you can.

Problem is I’m not a student, i\and I’ve had one accident in a year..

Hi Shaun,

We published an article that may be useful to you — it’s about a company called Good 2 Go Auto Insurance, which offers an aggregate tool that can help you get quotes from an array of insurance companies. (The post also has a helpful list of other discounts that you may be eligible for.) Not all states are served by Good 2 Go yet, but it’s worth investigating to see if Good 2 Go can find you anything cheaper than what you’re already paying. You can reach the Good 2 Go website directly here. Best of luck!

I have one question. Are you single? Holy cow you’re on the ball, and that’s quite attractive.

Okay, let’s overlook my plebeian feels. I’m currently trying to get a low rate. Parents just dropped me from their plan, so naturally every quote I’ve gotten has been sky-high ($60 from Allstate is lowest, and I consider that sky-high. I’m a tightwad).

Would LOVE to pay 20/month.

Hi Hailey,

Thanks for the compliment. Are you uninsured at the moment? When you’re getting quotes from various insurance companies, do you say ‘yes’ when asked if you’re currently insured? This can make a big difference in the quote you receive.

No in currently under my parents. Their policy is set to expire in a week. That gave me a discount (existing policy-holder & early sign-on). Even with good student discount, secondary driver (mom [good driving record]) ‘low mileage’ discount, ‘no previous accidents/infractions discount,’ & driving a 99′ Camry put me at 62/mo. I kept being told that a lot of it is my age and that Texas is one of the most expensive states for liability. You got lucky mister Nebraska.

Everyone else quoted me over 100. No thanks. Ha.

Okay because if you weren’t currently insured – quotes would be way higher. I ran an experiment to see just how much higher. I called four different places and the quotes I received were about 55% higher when I told them I didn’t have insurance as when I told them I had existing insurance. It’s unfortunate for people who just don’t need a car for a year and then try to get insured again.

Make sure you’ve called every major insurance provider. I know it’s a lot of work but if you’re able to save even $10 every month moving forward, your ‘pay’ for making these calls is pretty high. It sounds like you’ve done a lot of calling already so you may have to bite the bullet at $62. Like real estate, location, location, location.

I see that you have insurance for 18.00 month so why am I paying 76.20 a month don’t tell me its because of the age of my car or the age of the driver

you up my insurance every year why?

maybe it’s time I start looking for cheaper insurance

I searched around a lot before I found $18/month insurance. I encourage you to search around as well. Another big factor to consider is if you live in a high risk neighborhood. Then insurance companies need to charge you more since there’s a greater risk of your car being damaged.

Knowing about the cheapest auto insurance is quite fascinating. What would make the rate of an insurance go down? This question has me wanting to know more about since it’s what my son would also need to know.

Hi Andre, there are many things your son can do to lower his auto insurance quote. Here are the big ones:

1. Ask about a company’s discounts and snag as many as possible: good student, accident-free, a member of a club, etc.

2. Pre=pay your policy instead of going month-by-month

3. Take a defensive driving class

4. Drive fewer miles per year

5. Avoid getting any traffic violations

6. Drive a lower-priced car that you own outright

7. Shop for a better rate each year

Best of luck!

How do you without an insurance agent and it seems to be such a huge requirement.

Agents have no role in the 21st century. Foregoing an agent means more money saved and a better understanding of what it is you’re purchasing. If you’re willing to spend a little time researching and thinking critically, you can do well without one.

It is mandated by law to get car insurance, right? Hence, its fair that we go for cheapest insurances. I think they dont have difference with the expensive ones.

Liability insurance (what I have) is compulsory in 49 states. New Hampshire does not require any form of auto insurance. But in New Hampshire, you are required to pay for costs of bodily injury and property damage that occurs after a crash. So you’d be crazy not be get it.

No one can say without running a quote. Way too many factors to consider. I’d start with GEICO, esurance, and Progressive. They seem to be the cheapest 3.

Seriously impressive, Will! Thanks for posting. I’m at $43/month for liability and I thought I was doing good!

It seems like mostly everyone new driver and even those who have just bought a car do their search of finding an affordable auto insurance. I myself am doing the same thing but for my daughter. It seems like for her it’s getting easier since she just got her license and is still pretty young.

I would love to only have to pay $18 a month for car insurance! Though, I’m not the only one on my policy, so that might be a little difficult to pull off. I’ll have to see if there are any other insurance options available for my family that might help bring down the monthly rate.

I would think having multiple cars on a policy would mean a cheaper rate-per-car. Just like with cell phones. I’d definitely give GEICO a call and see what they can do.

That is really a relief to know that they will allow multiple people on the policy. That will definitely save us a lot of money in the long run. My wife and I are in the process of looking for car insurance. We’ve done quite a bit of research, and there really are a lot of affordable options out there if you keep your eyes open.

I know that if you are a really good driver and you are very smart with your money, you can get really good deals. I don’t remember what I had in high school, but my insurance cost was pretty low. That was heavily impacted by my grades in school I liked that they had a good student discount. It really made payments cheaper and made you want to drive good and have good grades.

I think that it is really interesting that you would recommend not going with an insurance agent. It makes sense that we would be the ones that pay for their income and thus our payments would be higher. I guess it just never clicked like that before though. Thanks for sharing.

How long have you been driving? I’m about to turn 20, had my license about a year and a half, and just started my own policy with Geico at $78/month (for minimum coverage). I know as a young driver, they consider me more of a liability and so my rates are probably higher than average, but I’m curious at what point that should change.

Wow, here in LA state minimum is 15k/30k and GEICO quote me 115$/month for it. Mine is All State and I get 80$/month and everybody at the office wet their pants when they hear how low it is xD.

I assume you’re talking about Louisiana, not Los Angles. What makes Louisiana so expensive??

Is good to go is it a good insurance

Hey Joseph,

Check out the review here: http://firstquarterfinance.com/good-2-go-auto-insurance-review/

The only thing I would caution is that as you get older and garner a higher net worth. The premium that you save to self insure may or may not be worth the savings if you were to have an accident happen. Lawsuits and such. The benefit of dealing with a local agent is having someone local that you can work with. Although any more most agents do not handle the claim side of things, depends on the company. Having the Cheapest policy is great but not if it doesn’t cover what you expect it to. Go over every aspect of your policy if you don’t understand the coverage google it, ask questions etc… This will become even more important when you purchase a home etc… The no lapse is a very important detail and interestingly so is switching companies to often. Credit score also play’s a part in the premium you pay. I was an agent with Metlife for 3 years and sold quite a few policies with them. I always treated my clients the same as I would have wanted to be treated. Meaning I tried to get them the coverage they expected at the best rate even if it meant I didn’t get the sale. Good agents do exist but many won’t waste their time if you tell them you are price shopping. Call Center employee’s for the firms generally don’t know as much about the policy’s and coverage’s they are selling you.

Brian

First off, that is one killer comment! Much appreciated!

I’ve checked every detail of what this policy covers and I’m satisfied. True, if clip a few Ferrari’s on my way home I’ll be in a financial pickle. But here in Nebraska, expensive cars are rare so I’m not worried. Also, I rarely even drive my car since I bike everywhere in town (most people should, too) so my chances of actually getting in an expensive accident are very, very low.

You’re so right about insurance agents not responding to price shoppers. I basically told one guy, “GEICO quoted me $18, can you do better?” He told me he could give me a personal experience and I was like…. Hmm, can’t quantify… “No, thanks.”

True, call center reps don’t know nearly as much as an experienced agent. But who cares? They have doc. and a handy FAQ compiled by experts. You don’t need to know everything, you just need quick access. In a digital world, the definition of expert is changing from someone who knows a lot to someone who can access a lot.

Thank you for your military service.

Will,

Wow – that is some seriously cheap insurance. We are due to renew ours in the next two weeks. I will definitely give Geico a look.

GEICO FTW. I LOVE them. Love, love, love. You won’t regret the switch if that’s what you decide.

I can vouch for the affordability of Gieco. I just switched to them this past april and saved $428 on my six month policy. Mine is $65/month but I have full coverage.

I still can’t believe how cheap this is! Mine works out to be about $8 a week, so $32 a month, which is for full insurance. I think insurance is cheaper here because we don’t have to worry about getting sued. Soon I’ll be paying $0 per month for car insurance and my hack is: being on holiday permanently. Sounds good to me!

Dude, that’s absolutely awesome! My insurance is $256 per month…OK, I don’t have the best driving record in the world, but I’d hardly agree with 2 tickets being that much liability. Anyway, I need to shop around…off to Geico, thanks for the tips!

Hey, Josh! You’re welcome! But you’re from Oregon.. I thought people only rode bicycles there. 🙂

Great article, Will! Last time I checked, I think my premium was around $65/mo for my car so there is a lot of room for improvement… haven’t shopped around in a while.

The last two times I used my car insurance were when a freak hail storm in Arizona nailed my car, and when someone backed into my vehicle in a parking lot. Since I’m driving my car even less than I did before, it would be a great time to look around!

Thanks, Camille!!! I wish it had more interesting photos like your posts!

Good on you for never having an at-fault accident! In Nebraska, accomplishing that feat is easy but in CA… so many people to hit! HAHA.

If you’re unsure if it’s all worth the effort, I would just skip everyone else and call GEICO. Wouldn’t take long at all and it should be less than $65.

Man, it really seems like I’m sponsored by GEICO doesn’t it? Oh, well!

That’s pretty low… I pay $40/mo for a beat up Caddy that I rarely drive 🙂 But I also have the deductible semi-low since I’m so used to getting in car accidents haha… I’m afraid it’s on its last legs though after someone just hit her last week!

I red (get it?) that article and felt so bad for your Pimp Daddy Caddy!

I love those big cars. I drove one in college until a mean ol’ lady ran me off the road and totaled her. At least she wasn’t drunk though!

“Getcha clown cousins and get some hammers and come bang this stuff out baby!” -Bernie Mac in “Transformers”

I’d give GEICO a call after bangin’ out the Caddy lol.

That’s pretty good. Have you taken a defensive driver course? I took a course online that was approved by the state and it saved me 10% for the next three years. The course was only $19 and it’s a total of two hours, which you can save and come back to it later.

Every state is different, but you should look into it and save even more money.

Great tip, Aldo!

Unfortunately I checked earlier and for me there’s no safe driver program in Nebraska I can take to reduce my insurance rate. However, your comment may help others!

I’ll say ‘thank you’ on their behalf! Thank you. 🙂

I’m with Geico, as is my boyfriend. When we moved, our premiums decreased considerably. Before that, he had tried to call to get a lower price, and as you said, they weren’t helpful with that. My premium is $184; I’ve never been in an accident or gotten any tickets/fines. The only discounts I have are a 5 year good driver and passive restraint. I’ve been with Geico for a while now – when I shopped around no one else was willing to go as low as them.

Once I heard GEICO’s quote, I knew it would be hard to beat. I still called other insurance companies but I usually started the call with, “GEICO quoted me $18, can you do better?”

Most of them flat out told me there’s no way.

I hate Geico !! They don’t listen…well wonder why? They are the Government employee’s ins. Co. They assume and then they act on that assumption regardless before they know the facts.

That sounds like a good rate, but I bet you can do better. The issue with staying with one insurance company and being a “loyal customer” is that they almost always raise your rates when it comes time to renew. Kind of like how your landlord increases your rent every year. I like to shop around and get a cheaper rate whenever that happens. This year I’m paying $24/month (thru Insurance Panda), but my lease is about to expire so it’s time to start looking around for better rates. Any suggestions?